PRE 14A: Preliminary proxy statement not related to a contested matter or merger/acquisition

Published on April 10, 2024

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

(RULE 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

Payment of Filing Fee (Check the appropriate box):

☒ No fee required

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11

1) Title of each class of securities to which transaction applies:

2) Aggregate number of securities to which transaction applies:

3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

4) Proposed maximum aggregate value of transaction:

5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

1) Amount Previously Paid:

2) Form, Schedule or Registration Statement No.:

3) Filing Party:

4) Date Filed:

BARRETT BUSINESS SERVICES, INC.

8100 NE Parkway Drive, Suite 200

Vancouver, Washington 98662

(360) 828-0700

April [__], 2024

Dear Stockholder:

Our annual meeting of stockholders will be held at 1:00 p.m., Pacific Time, on Monday, June 3, 2024. Our annual meeting will be held solely via remote communication, as permitted by Maryland law. You will find instructions explaining how to participate in the meeting on the first page of our proxy statement.

Matters to be presented for action at the meeting include the election of directors; a proposal to increase the authorized shares of our Common Stock, which will facilitate a planned 4-for-1 split of the Company’s common stock in the form of a stock dividend; an advisory vote to approve our executive compensation program; and ratification of the selection of our independent auditors. We will also act on such other business as may properly come before the meeting or any postponements or adjournments thereof.

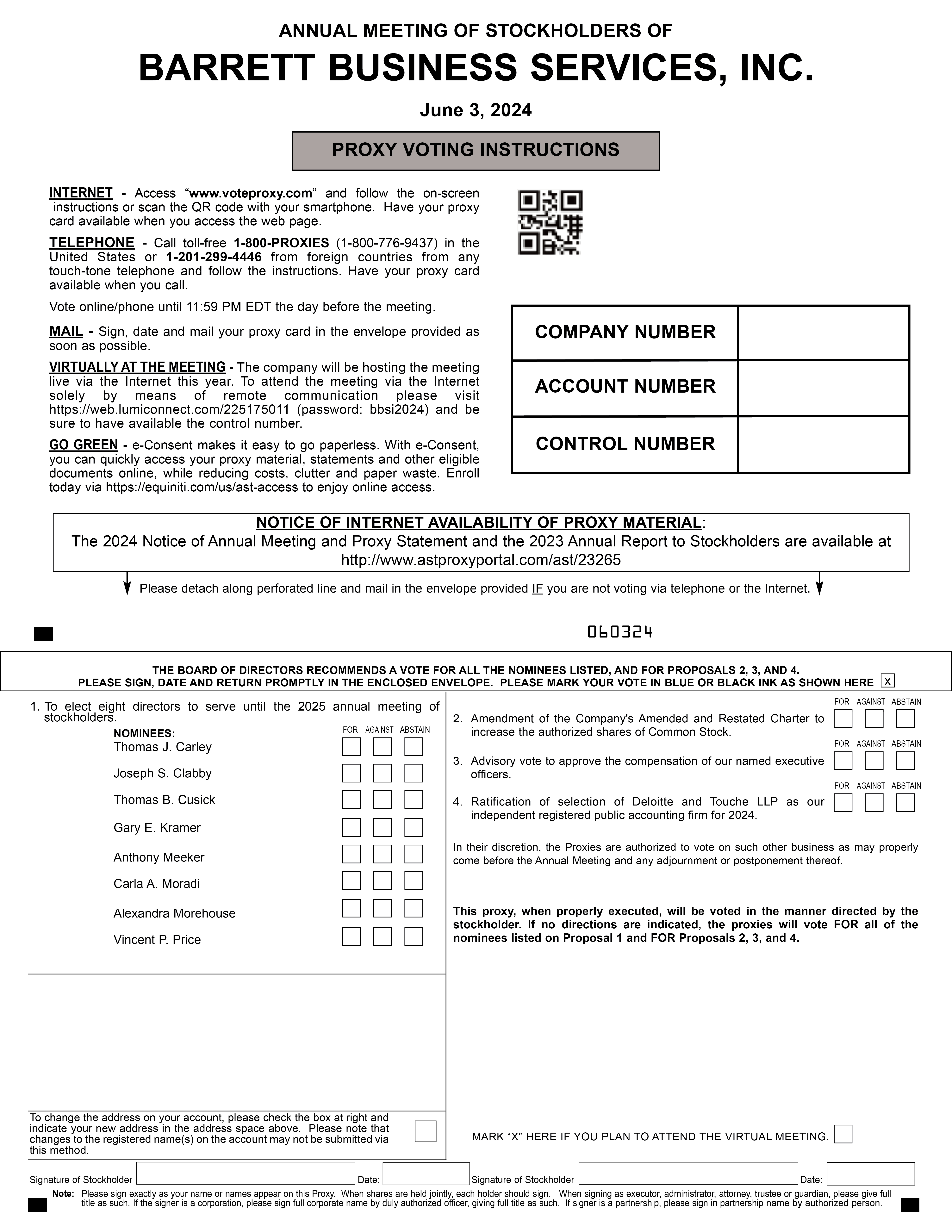

Whether or not you plan to participate in the annual meeting, please promptly vote and submit your proxy by following the applicable instructions for telephone or Internet voting or, if you received your proxy materials by mail, by signing, dating, and returning the enclosed proxy card or voting instruction form in the envelope provided for your convenience. Please refer to the information you received by mail or as otherwise forwarded by your broker or other nominee to see which voting methods are available to you.

|

Sincerely, |

|

Gary E. Kramer |

President and Chief Executive Officer |

BARRETT BUSINESS SERVICES, INC.

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

June 3, 2024

You are invited to attend the virtual annual meeting of stockholders (the "Annual Meeting") of Barrett Business Services, Inc., a Maryland corporation (the "Company"), to be held solely by remote communication via live webcast on Monday, June 3, 2024, at 1:00 p.m., Pacific Time. You may attend the live webcast on the internet by visiting https://web.lumiconnect.com/225175011. The password for the meeting is bbsi2024.

The Annual Meeting is being held to consider and vote on the following matters:

5. The transaction of any other business that may properly come before the Annual Meeting and any postponement or adjournment thereof.

If you were a stockholder of record or beneficial owner at the close of business on April 8, 2024, you may vote on the proposals presented at the Annual Meeting. On or about April 24, 2024, we expect to mail to our stockholders of record and beneficial owners a Notice of Internet Availability of Proxy Materials (the "Notice"), unless they have elected to receive the materials in a different manner. The Notice provides instructions on how to access and review all of the important information contained in the Proxy Statement and Annual Report to Stockholders. Please follow the instructions in the Notice to vote your proxy. If you receive the Notice and would still like to receive a printed copy of our proxy materials by mail, instructions for requesting these materials are included in the Notice. Additionally, the Proxy Statement and our Annual Report can be accessed directly at the following Internet address: http://www.astproxyportal.com/ast/23265.

Whether or not you plan to attend the virtual Annual Meeting, please vote your shares via the Internet, by telephone, or by signing, dating, and returning the proxy card or voting instruction form, to avoid the expense of further solicitation. If you attend the Annual Meeting virtually, you may revoke your proxy and vote your shares at that time. Please refer to the Notice, Proxy Statement, or the information forwarded by your broker or other nominee to see which voting methods are available to you.

|

By Order of the Board of Directors

|

|

James R. Potts |

Secretary |

Vancouver, Washington

April [__], 2024

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON JUNE 3, 2024:

Notice of Internet Availability of Proxy Materials

Under the "notice and access" rules of the Securities and Exchange Commission (the "SEC"), we are able to provide access to our proxy materials, including our proxy statement for the 2024 annual meeting of stockholders and 2023 annual report to stockholders, through the Internet by mailing a Notice of Internet Availability of Proxy Materials (the "Notice") to our stockholders. Our Board of Directors is soliciting your proxy to vote at our Annual Meeting, including at any adjournments or postponements of the meeting. The Notice includes instructions on how to access our proxy materials over the Internet or to request a printed copy.

We expect the Notice will be mailed to our stockholders entitled to vote at our Annual Meeting on or about April 24, 2024.

Householding of Proxy Materials

The SEC has adopted rules that permit companies and intermediaries (e.g., brokers) to satisfy the delivery requirements for the Notice or other Annual Meeting materials with respect to two or more stockholders sharing the same address by delivering a single Notice to those stockholders. This process, which is commonly referred to as "householding," potentially means extra convenience for stockholders and cost savings for companies.

This year, a number of brokers with account holders who are stockholders in the Company will be householding our proxy materials. A single Notice will be delivered to multiple stockholders sharing an address unless contrary instructions have been received from the affected stockholders. Once you have received notice from your broker that they will be householding communications to your address, householding will continue until you are notified otherwise or until you revoke your consent. Stockholders who hold their shares in "street name" (that is, through a broker or other nominee) and currently receive multiple copies of the Notice at their address and would like to request householding of their communications should contact their broker.

If your shares are registered in your own name and if you no longer wish to participate in householding and would prefer to receive a separate Notice, please direct your written request to Equiniti Trust Company, LLC ("Equiniti"), Attn: Proxy Tabulation Department, 55 Challenger Rd. Suite 200B 2nd floor, Ridgefield Park, NJ 07660, or you may reach Equiniti by telephone at 800-937-5449. If your shares are registered in your own name and you are interested in participating in householding, you may enroll by going directly to the Equiniti website anytime, at https://equiniti.com/us/ast-access and following the instructions.

PRELIMINARY COPY DATED APRIL 10, 2024 – SUBJECT TO COMPLETION

BARRETT BUSINESS SERVICES, INC.

8100 NE Parkway Drive, Suite 200

Vancouver, Washington 98662

(360) 828-0700

PROXY STATEMENT

2024 ANNUAL MEETING OF STOCKHOLDERS

This proxy statement is furnished in connection with the solicitation of proxies by the Board of Directors (the "Board") of Barrett Business Services, Inc., a Maryland corporation (the "Company"), for use in voting at the annual meeting of stockholders to be held on June 3, 2024 (the "Annual Meeting"), and any postponement or adjournment thereof. Notices are expected to be mailed to stockholders beginning on approximately April 24, 2024. Website references throughout this document are provided for convenience only, and the content on the referenced website is not incorporated by reference into this document.

VOTING, REVOCATION, AND SOLICITATION OF PROXIES

This year’s Annual Meeting will again be held as a virtual meeting of stockholders conducted online solely by remote communication via live webcast. You will be able to attend and participate in the Annual Meeting online on Monday, June 3, 2024, at 1:00 p.m. Pacific Time, and may also vote your shares electronically (by following the procedures described below) and submit any questions you may have during the meeting, by visiting: https://web.lumiconnect.com/225175011. The password for the meeting is bbsi2024.

When a proxy is properly voted and submitted via the Internet or by telephone, or executed and mailed in the accompanying postage prepaid envelope for those receiving paper copies, the shares represented will be voted at the Annual Meeting in accordance with the instructions specified in the proxy. We encourage you to submit your proxy promptly, by following the instructions on the Notice, or by mail for paper proxy cards, even if you plan to attend the Annual Meeting. If no voting instructions are specified on a properly submitted proxy, the shares will be voted FOR Proposals 1, 2, 3, and 4 in the Notice of Annual Meeting of Stockholders accompanying this proxy statement.

Voting Your Shares Now or at the Annual Meeting. To vote now, follow the instructions on the Notice or on your proxy card or voting instruction form. If you are a record holder, you may vote your shares at the Annual Meeting if you log in with your unique control number on your Notice or proxy card.

If you are a beneficial owner and do not provide specific voting instructions to your broker, the firm that holds your shares will not be authorized to vote your shares (known as a "broker non-vote") on non-routine matters under the New York Stock Exchange rules governing discretionary voting by brokers. As of the date of this proxy statement, we believe that Proposals 1 and 3 will be non-routine, but that Proposals 2 and 4 will be deemed to be routine, such that brokers will be able to vote on Proposals 2 and 4 without customer instructions.

Beneficial owners are invited to attend the Annual Meeting and may ask questions during the meeting. However, as a beneficial owner is not the stockholder of record, you may not vote your shares in person at the Annual Meeting unless you follow your broker’s procedures for obtaining a legal proxy. If you request a printed copy of the proxy materials by mail, your broker or nominee will provide a voting instruction form for you to use.

- 1 -

After obtaining a valid legal proxy from your broker or other nominee, you may register to vote at the Annual Meeting, by submitting proof of your legal proxy reflecting the number of your shares along with your name and email address to Equiniti. Requests for registration should be directed to proxy@equiniti.com or to facsimile number 718-765-8730. Written requests may also be mailed to:

Equiniti Trust Company, LLC

Attn: Proxy Tabulation Department

55 Challenger Rd. Suite 200B 2nd floor

Ridgefield Park, NJ 07660

Requests for registration must be labeled as "Legal Proxy" and be received no later than 5:00 p.m., Eastern Time, on May 24, 2024. Any reference herein to attending the Annual Meeting, including any reference to "in person" attendance, means attending by remote communication via live webcast on the Internet.

Any proxy given pursuant to this solicitation may be revoked by the person giving the proxy at any time prior to its exercise by written notice to the Secretary of the Company of such revocation, by a later-dated proxy received by the Company, or by attending the Annual Meeting and voting at the Annual Meeting. The mailing address of the Company’s principal executive offices is 8100 NE Parkway Drive, Suite 200, Vancouver, Washington 98662. If your shares are held through a broker or other nominee, please follow their directions on how to change or revoke your voting instructions.

The solicitation of proxies will be made by mail and may also be solicited personally or by telephone or email by our directors and officers without additional compensation for such services. The Company will reimburse banks, brokerage firms and other custodians, nominees and fiduciaries for their reasonable expenses in sending proxy materials to stockholders. All costs of solicitation of proxies will be borne by the Company.

OUTSTANDING VOTING SECURITIES

The close of business on April 8, 2024, has been fixed as the record date for the determination of stockholders entitled to notice of and to vote at the Annual Meeting. On the record date, the Company had 6,536,500 shares of Common Stock, $.01 par value ("Common Stock"), outstanding. Each share of Common Stock is entitled to one vote at the Annual Meeting. The presence, in person or by proxy, of stockholders entitled to cast a majority of all votes entitled to be cast at the Annual Meeting is required to constitute a quorum. Abstentions and broker non-votes, if any, will be considered present for purposes of determining the presence of a quorum.

- 2 -

PROPOSAL 1: ELECTION OF DIRECTORS

The director nominees will be elected at the Annual Meeting to serve until the next annual meeting of stockholders and until their successors are elected and qualify. Our Charter and Bylaws authorize the Board to set the number of positions on the Board within a range of three to nine, with the current number fixed at eight. Vacancies on the Board, including vacancies resulting from an increase in the number of positions, may be filled by the Board for a term ending with the next annual meeting of stockholders and when a successor is duly elected and qualifies.

Provided that a quorum is present at the Annual Meeting, a nominee will be elected if the nominee receives the affirmative vote of a majority of the total votes cast on his or her election (that is, the number of shares voted "for" a director nominee must exceed the number of votes cast "against" that nominee). All of our director nominees are currently serving on the Board. Even if a nominee who is currently serving as a director is not re-elected, Maryland law provides that the director would continue to serve on the Board as a "holdover director." However, under our Bylaws, if stockholders do not re-elect a director, the director is required to submit his or her resignation to the Board. In that event, our Nominating and Governance Committee (the "Nominating Committee") would recommend to the Board whether to accept or reject the resignation. The Board would then consider and act on the Nominating Committee's recommendation, publicly disclosing its decision and the reasons supporting it within 90 days following the date that the resignation was submitted.

A duly executed proxy will be voted FOR the election of the nominees named below, other than proxies marked to vote "against" or to "abstain" from voting on one or more nominees. Shares not represented in person or by proxy at the Annual Meeting, shares voted to "abstain," and broker non-votes, if any, will have no effect on the outcome of the election of directors.

The Board recommends that stockholders vote FOR each of the nominees named below to serve as a director until the next annual meeting of stockholders and his or her successor is duly elected and qualifies. If for some unforeseen reason a nominee should become unavailable for election, the proxy may be voted for the election of such substitute nominee as may be designated by the Board.

The following table sets forth information with respect to each person nominated for election as a director, including their current principal occupation or employment and age as of April 1, 2024.

Name |

|

Principal Occupation |

|

Age |

|

Director Since |

Thomas J. Carley |

|

Retired Chief Operating Officer of Urth Organic Corporation |

|

65 |

|

2000 |

|

|

|

|

|

|

|

Joseph S. Clabby |

|

Retired Vice President at Chubb Limited |

|

70 |

|

2022 |

|

|

|

|

|

|

|

Thomas B. Cusick |

|

Retired Executive Advisor of Columbia Sportswear Company |

|

56 |

|

2016 |

|

|

|

|

|

|

|

Gary E. Kramer |

|

President and Chief Executive Officer of the Company |

|

44 |

|

2020 |

|

|

|

|

|

|

|

Anthony Meeker |

|

Retired Managing Director of Victory Capital Management, Inc., Cleveland, Ohio |

|

85 |

|

1993 |

|

|

|

|

|

|

|

Carla A. Moradi |

|

Board member of the Company and Patriot Growth Insurance Services, LLC |

|

59 |

|

2021 |

|

|

|

|

|

|

|

Alexandra Morehouse |

|

Board member of the Company and Evalueserv, Inc. |

|

65 |

|

2022 |

|

|

|

|

|

|

|

Vincent P. Price |

|

Advisor to the Chief Executive Officer of Cambia Health Solutions, Inc. |

|

60 |

|

2017 |

The Nominating Committee evaluates the Board’s membership from time to time in determining whether to recommend that incumbent directors be nominated for re-election. In this regard, the Nominating Committee considers whether the professional and educational background, business experience and expertise represented on the Board as a whole enable it to satisfy its oversight responsibilities in an effective manner.

The experience, qualifications, attributes, and skills of each director nominee, including his or her business experience during the past five years, are described below.

Thomas J. Carley served as Chief Operating Officer of Urth Organic Corporation, a distributor of organic agricultural products, from August 2018 to June 2023. From July 2006 to June 2018, Mr. Carley acted as principal of Portal Capital, an investment management company that he co-founded, with responsibility for all of Portal Capital’s financial duties. Mr. Carley has an MBA from the University of Chicago Graduate School of Business, with an emphasis in Accounting and Finance, and an A.B. degree in Economics and Classics from Dartmouth College. He is also a director of Urth Organic Corporation and a Trustee and Treasurer of the Tracy Memorial Library in New London, NH.

- 3 -

Mr. Carley brings financial expertise to the Company and the Board through his prior experience in the areas of public accounting and financial analysis, including experience as an accountant with Price Waterhouse & Co., now known as PricewaterhouseCoopers LLP, as well as President and Chief Financial Officer of Jensen Securities, a securities and investment banking firm in Portland, Oregon, for eight years in the 1990s. He is the chair of the Board’s Nominating Committee.

Joseph S. Clabby, before retiring in 2022, spent over 20 years with ACE Limited and then Chubb Limited, a global insurance and reinsurance organization, following its merger with ACE in 2016, in a number of senior executive positions, including board roles at several affiliated companies. Prior to ACE and Chubb, Mr. Clabby held underwriting, broker and executive roles with leading insurance and reinsurance organizations including Alexander & Alexander, Willis Group and Swiss Re. Mr. Clabby earned his MBA in Finance from Pace University and his Master of Arts in Education from Montclair State University. He completed his undergraduate degree at Fordham University, majoring in Psychology.

Mr. Clabby brings extensive insurance industry experience to the Board with specific expertise in underwriting, risk management, and operational and financial leadership through his experience as an executive officer of a multinational public company.

Thomas B. Cusick served as Executive Advisor of Columbia Sportswear Company, an outdoor and active lifestyle apparel and footwear company listed on the Nasdaq Global Select Market, from 2021 until August 2023. He previously served as Executive Vice President and Chief Operating Officer of Columbia beginning in July 2017 and as Columbia’s Executive Vice President and Chief Financial Officer from 2015 until 2017. He joined Columbia in 2002 as Corporate Controller and was promoted to Chief Financial Officer in 2009. Prior to joining Columbia, Mr. Cusick spent seven years with Cadence Design Systems, Inc. (and OrCAD, a company acquired by Cadence in 1999), a public company that develops system design enablement solutions, and certain of its subsidiaries. Mr. Cusick currently serves as a member of the Board of Directors and Chair of the Audit Committee of Rather Outdoors Corporation, a privately held fishing equipment business. He received a B.S. degree in accounting from the University of Idaho and began his career at the public accounting firm of KPMG, LLC.

Mr. Cusick brings financial and senior leadership expertise to the Board through his experience as an executive officer of a public company and his work with public company audit committees. He is the chair of the Board’s Audit and Compliance Committee.

Gary E. Kramer joined the Company on August 1, 2016, as Vice President – Finance and served as the Company’s Chief Financial Officer and Principal Accounting Officer until March 5, 2020, when he was elected President and Chief Executive Officer of the Company. Mr. Kramer has more than 15 years of insurance industry expertise, joining the Company after serving 12 years with Chubb Limited—the world’s largest publicly traded property and casualty insurer. Mr. Kramer holds a Bachelor of Science degree in business administration with a specialization in finance from Rowan University and an MBA with a specialization in accounting from Drexel University.

Mr. Kramer brings to the Board extensive experience in senior leadership positions as well as deep industry and financial acumen.

Anthony Meeker serves as Chairman of the Board. He retired in 2003 as a Managing Director of Victory Capital Management, Inc., an investment management firm, where he was employed for 10 years. Mr. Meeker was previously a director of First Federal Savings and Loan Association of McMinnville, Oregon and Oregon Mutual Insurance. He also serves on the board of two charitable organizations, MV Advancements, which provides employment, residential, and community services to clients with disabilities, and Oregon State Capitol Foundation. From 1987 to 1993, Mr. Meeker was Treasurer of the State of Oregon. His duties as state treasurer included investing the assets of the state, including the then $26 billion state pension fund, managing the state debt, and supervising all cash management programs. Mr. Meeker also managed the workers compensation insurance reserve fund of the State Accident Insurance Fund, providing oversight to ensure adequate actuarial reserves. He received a B.A. degree from Willamette University.

Mr. Meeker’s experience in the insurance industry assists the Company in managing risk with respect to workers’ compensation and overseeing its insurance subsidiaries. Mr. Meeker also brings leadership skills and a unique insight stemming from his public service as state treasurer and service on other corporate boards.

Carla A. Moradi has served in several Senior Vice President roles, most recently of Global Partner & Alliances Organization, for Anaplan Inc., an enterprise SaaS company, from September 2020 until September 2023. Prior to Anaplan, Ms. Moradi was Executive Vice President of Operations and Technology for HUB International Limited, a leading North American insurance brokerage, beginning in 2015, and was previously Group Vice President and Chief Information Officer of Walgreens Boots Alliance Inc., a healthcare, pharmacy and retail company listed on the Nasdaq Global Select Market.

Ms. Moradi earned her MBA in Finance from Tulane University and her Master’s in Public Health from Tulane School of Public Health and Tropical Medicine. She completed her undergraduate degree at Knox College, majoring in Biology/Sociology. She has received a CERT Certificate in Cybersecurity Oversight from the Carnegie Mellon University Software Engineering Institute through a program developed by the NACD. Ms. Moradi currently serves as a member of the Board of Directors of Patriot Growth Insurance Services, LLC, a privately held insurance services firm and most recently served on the Executive Committee of the YMCA of the USA National Board until her term ended in March 2024.

- 4 -

Ms. Moradi brings her extensive knowledge and experience regarding information technology, data security and other risk management issues to the Board. She is the chair of the Board’s Risk Management Committee.

Alexandra Morehouse served as Chief Marketing Officer & Chief Digital Officer of Banner Health from August 2015 until October 2023. Banner Health is a not-for-profit health system based in Phoenix, Arizona, operating 30 hospitals and several specialized facilities across 6 states. Prior to Banner Health, Ms. Morehouse served in leadership roles with American Express, Charles Schwab, California State Automobile Association, and Kaiser Permanente. Ms. Morehouse currently serves as a member of the Board of Directors of Evalueserve, Inc., a privately held leading global analytics and artificial intelligence consultancy. Ms. Morehouse is also a founding board member of Alliance for Multicultural and Inclusive Marketing, a national coalition whose purpose is to create a movement that reflects a world of acceptance by celebrating differences and highlighting human truths that unite us. She earned a bachelor’s degree at Harvard University and a Master in Business Administration degree from Harvard Business School. Ms. Morehouse is NACD Directorship Certified®.

Ms. Morehouse brings to the Board her extensive knowledge and experience regarding marketing, including enterprise-wide digital transformation and branding, as well as corporate governance and diversity and inclusion issues.

Vincent P. Price has served as an advisor to the Chief Executive Officer of Cambia Health Solutions, Inc. ("Cambia"), a nonprofit healthcare solutions company headquartered in Portland, Oregon, since October 2023, and prior to that served as Executive Vice President and Chief Financial Officer of Cambia. Mr. Price joined Cambia in 2009. Prior to joining Cambia, he spent 15 years as a senior finance executive with Intel Corporation, a leader in the design and manufacturing of advanced integrated digital technology platforms, followed by seven years as a consultant to start-up companies. He served on the board of trustees of BCS Financial’s Plan Investment Fund and the Oregon Health Sciences University Foundation. He was also a founding member and treasurer of the Children’s Heart Foundation, Oregon Chapter. He received his bachelor's degree in business from South Dakota State University. His Master of Business Administration is from Arizona State University.

Mr. Price brings his business, financial, and risk management experience as an executive officer of a large health care organization to the Board. He is the chair of the Board’s Compensation Committee.

The Board recommends that stockholders vote FOR each of the nominees named above.

- 5 -

Board Diversity Matrix

The table below provides certain highlights of the composition of our Board of Directors assuming the election of the eight nominees listed above. Each of the categories listed in the table below has the meaning set forth in Rule 5605(f) adopted by The Nasdaq Stock Market ("Nasdaq").

Board Diversity Matrix

Total Number of Directors |

|

8 |

||||||

|

|

Female |

|

Male |

|

Non- |

|

Did Not |

Part I: Gender Identity |

|

|

|

|

|

|

|

|

Directors |

|

2 |

|

6 |

|

0 |

|

0 |

Part II: Demographic Background |

|

|

|

|

|

|

|

|

African American or Black |

|

0 |

|

0 |

|

0 |

|

0 |

Alaskan Native or Native American |

|

0 |

|

0 |

|

0 |

|

0 |

Asian |

|

0 |

|

0 |

|

0 |

|

0 |

Hispanic or Latinx |

|

1 |

|

0 |

|

0 |

|

0 |

Native Hawaiian or Pacific Islander |

|

0 |

|

0 |

|

0 |

|

0 |

White |

|

2 |

|

6 |

|

0 |

|

0 |

Two or More Races or Ethnicities |

|

1 |

|

0 |

|

0 |

|

0 |

LGBTQ+ |

|

0 |

||||||

Did Not Disclose Demographic Background |

|

0 |

||||||

Section 16(a) Beneficial Ownership Reporting Compliance

Section 16 of the Exchange Act ("Section 16") requires that reports of beneficial ownership of Common Stock and changes in such ownership be filed with the SEC by Section 16 "reporting persons," including directors, executive officers, and certain holders of more than 10% of the outstanding Common Stock. To the Company's knowledge, based solely on a review of the copies of Forms 3, 4, and 5 (and amendments thereto) filed with the SEC and written representations by the Company's directors and executive officers, all Section 16 reporting persons complied with all applicable Section 16(a) filing requirements during 2023 on a timely basis.

Meetings and Committees OF THE BOARD OF DIRECTORS

The Board held seven meetings in 2023. Each director attended at least 85% of the total number of the meetings of the Board and the meetings held by each committee of the Board on which he or she served during his or her respective periods of service in 2023.

The Company does not have a policy regarding directors' attendance at the Company's annual meeting of stockholders. All directors in office as of last year's annual meeting attended the meeting.

The Board has determined that Ms. Morehouse, Ms. Moradi, and Messrs. Carley, Clabby, Cusick, Meeker and Price are independent directors as defined in Rule 5605(a)(2) of the listing standards applicable to companies listed on Nasdaq. In making that determination, the Board took into consideration certain business relationships that the Company has with entities of which directors are or were employees, as follows:

- 6 -

Board Leadership Structure

Gary E. Kramer was appointed the Company’s Chief Executive Officer on March 5, 2020, and became a director on May 27, 2020. Anthony Meeker, a long-time outside director of the Company, serves as Chairman of the Board. Mr. Meeker is an ex officio member of each Board committee of which he is not a voting member.

Throughout 2023, each of our directors, other than Mr. Kramer, qualified as an independent director under the Nasdaq listing rules. The outside directors also meet at least two times per year in executive session without the President and Chief Executive Officer or other management being present.

The Board believes that its longstanding leadership structure reflecting the separation of the Chairman and Chief Executive Officer positions serves the best interests of the Company by giving an independent director a direct and significant role in establishing priorities and the strategic direction and oversight of the Company. The Board believes that the manner in which it oversees risk management at the Company has not affected its leadership structure.

The Board’s Role in Risk Oversight

The Company's management is responsible for identifying, assessing, and managing the material risks facing the Company. The Board has historically performed an important role in the review and oversight of risk, and generally oversees risk management practices and processes at the Company. The Board, either as a whole or through the Audit and Compliance Committee (the "Audit Committee"), the Risk Management Committee, and other Board committees, periodically discusses with management the risks associated with the Company and its operations, their potential impact on the Company, and the steps being taken to manage these risks.

While the Board is ultimately responsible for risk oversight, the Board's committees assist the Board in fulfilling its oversight responsibilities in certain areas of risk. In particular, the Audit Committee focuses on financial risk and, through discussions by the Audit Committee or its Chair with management and the Company’s independent registered public accounting firm (the "independent auditors"), oversees the Company's policies, practices, and internal controls related to the preparation of the Company's financial statements and other public disclosures. The Audit Committee also reviews the Company’s major financial risk exposures and the steps management is taking to monitor and control such risks.

The Nominating Committee oversees the functioning of the Board and its committees, issues and developments relating to the Company's corporate governance practices, succession planning for the Board and the Company's executive positions, and the Company’s ethics and compliance program other than with regard to issues assigned to the Audit Committee. The Compensation Committee monitors the Company's incentive compensation programs to assure that management is not encouraged to take actions involving excessive risk. The Risk Management Committee provides oversight of the Company's enterprise-wide risk management framework and corporate risk function, including the strategies, policies, procedures, processes, and systems established by management to identify, assess, measure, monitor, and manage the major risks facing the Company, other than risks for which responsibility has been assigned to a different Board committee.

Board Committees

Audit and Compliance Committee

The Audit Committee reviews and pre-approves audit and legally permitted non-audit services provided by the independent auditors, makes decisions concerning the engagement or discharge of the independent auditors, and reviews with management and the independent auditors the results of their audit, the adequacy of internal accounting controls and the Company’s internal audit function, and the quality of the Company’s financial reporting. The Audit Committee also oversees implementation of the Company's Code of Business Conduct and Code of Ethics for Senior Financial Officers, including procedures for the receipt, retention, and treatment of complaints received regarding accounting, internal accounting controls, or auditing matters. The Audit Committee reviews for potential conflicts of interest, and determines whether to approve, any transaction by the Company with a director or officer (including their family members) that would be required to be disclosed in the Company's annual proxy statement. The Audit Committee held six meetings in 2023.

- 7 -

The current members of the Audit Committee are Mr. Cusick (chair), Ms. Moradi, Ms. Morehouse, and Mr. Clabby. The Board has determined that Mr. Cusick is qualified to be an "audit committee financial expert" as defined by the SEC's rules under the Securities Exchange Act of 1934 (the "Exchange Act"). The Board has also determined that each current member of the Audit Committee meets the financial literacy and independence requirements for audit committee membership specified in applicable SEC rules and in listing standards applicable to companies listed on Nasdaq. The Audit Committee's activities are governed by a written charter, a copy of which is available on the Company's website at www.BBSI.com in the "Investors" section under "Governance."

Compensation Committee

The Compensation Committee reviews the compensation of executive officers of the Company and makes recommendations to the Board regarding base salaries and other forms of compensation to be paid to executive officers, including decisions to grant restricted stock units ("RSUs") and other stock-based awards. The current members of the Compensation Committee are Mr. Price (chair), Mr. Cusick, and Mr. Meeker, each of whom is "independent" as defined in Rule 5605(a)(2) and Rule 5605(d)(2)(A) of the listing standards for companies listed on Nasdaq. The Compensation Committee held eight meetings in 2023.

The Compensation Committee's responsibilities are outlined in a written charter, a copy of which is available on the Company's website at www.BBSI.com in the "Investors" section under "Governance." The Compensation Committee is charged with carrying out the Board's overall responsibilities relating to compensation of the Company's executive officers and non-employee directors. Its specific duties include reviewing the Company's cash incentive and equity compensation programs for executive officers and director compensation arrangements, and recommending changes to the Board as it deems appropriate. In the course of reviewing the Company's compensation policies and practices, the Compensation Committee considers whether the Company's compensation program encourages employees to take risks that are reasonably likely to have a material adverse effect on the Company. Based on its most recent review in April 2024, the Compensation Committee believes that the Company's compensation program is not likely to have that effect.

The Chief Executive Officer reviews the performance of each executive officer (other than himself) and may make recommendations to the Compensation Committee regarding salary adjustments, stock-based awards, and the selection, target amounts and satisfaction of corporate and individual performance goals for cash and stock incentive awards. The Compensation Committee is responsible for annually evaluating the CEO's performance and establishing his base salary and incentive compensation. At the invitation of the Committee chair, the Company's Chief Financial Officer may attend Compensation Committee meetings to provide information relevant to the Committee's determination of the satisfaction of corporate performance goals tied to cash and stock incentive compensation and the development of appropriate corporate performance targets for future awards of incentive compensation, as well as financial and accounting issues associated with the Company's executive compensation program. The Compensation Committee exercises its own discretion in accepting or modifying the CEO's recommendations regarding the performance and compensation of the Company's other executive officers. If present at a Compensation Committee meeting, each of the CEO and CFO is excused during discussions of his compensation.

The Compensation Committee also administers the Company's stock incentive plans. The Compensation Committee, as it deems appropriate and as permitted by applicable law, may delegate its responsibilities to a subcommittee under the Company's Amended and Restated 2020 Stock Incentive Plan (the "2020 Stock Plan"). The Compensation Committee has delegated authority, within specified limits, to the CEO (provided he is also a director) to make stock-based awards in his discretion to corporate and branch personnel who are not executive officers.

Under its charter, the Compensation Committee has the sole authority to retain the services of outside consultants to assist it in making decisions regarding executive compensation and other compensation matters for which it is responsible. For several years, the Compensation Committee has engaged Mercer, a nationally recognized compensation consultant, to assist the Committee in structuring and implementing the Company's executive compensation program. The Compensation Committee received information from Mercer regarding any potential conflicts of interest prior to each engagement and determined that no conflicts existed.

In October 2023, the Compensation Committee engaged Mercer to provide information regarding recent trends in the executive compensation arena, including trends in talent management and return-to-work policies, and recent executive pay practices, particularly with regard to annual merit increases and equity compensation. Mercer most recently advised the Compensation Committee on the competitiveness of its executive compensation program in late 2021, including an analysis of the composition of the Company’s peer group and market survey data to assess market levels of executive compensation. The Compensation Committee intends to obtain fresh data regarding the market competitiveness of its executive and director compensation programs in mid-2024.

- 8 -

Nominating and Governance Committee

The Nominating Committee evaluates and recommends candidates for nomination by the Board in director elections and otherwise assists the Board in determining the composition of the Board and its committees, including evaluating matters related to diversity and the performance of the Board and its members. The Nominating Committee is also responsible for reviewing issues and developments in corporate governance and considering whether to recommend changes in the Company’s corporate governance framework, overseeing succession planning with respect to the Company's executive officers, and overseeing the Company’s ethics and compliance program (other than issues related to accounting and financial reporting or within the responsibilities assigned to the Audit Committee). The current members of the Nominating Committee are Mr. Carley (chair), Mr. Price, Mr. Meeker, and Ms. Morehouse. The Nominating Committee held two meetings in 2023.

The Board has determined that each current member of the Nominating Committee is an independent director as defined in Rule 5605(a)(2) of the listing standards applicable to companies listed on Nasdaq. The Nominating Committee is governed by a written charter, which is available on the Company's website at www.BBSI.com in the "Investors" section under "Governance."

The Nominating Committee does not have any specific, minimum qualifications for director candidates. In evaluating potential director nominees, the Nominating Committee will consider, among other factors:

While the Board has not adopted a formal policy with respect to the consideration of diversity in identifying director nominees, the Nominating Committee believes it is important that the Board as a whole represent a diversity of backgrounds and experience, including gender and ethnic background. Accordingly, the Nominating Committee has committed to continue its search for diverse candidates to include in the pool from which future Board members will be chosen.

The Nominating Committee relies on its periodic evaluations of the Board in determining whether to recommend nomination of current directors for re-election. The Nominating Committee may poll current directors for suggested candidates and engage an executive search firm when called upon to identify new director candidates.

The Nominating Committee will also consider director candidates suggested by stockholders for nomination by the Board. Stockholders wishing to suggest a candidate to the Nominating Committee should do so by sending the candidate’s name, biographical information, and qualifications to: Nominating Committee Chair c/o Corporate Secretary, Barrett Business Services, Inc., 8100 NE Parkway Drive, Suite 200, Vancouver, Washington 98662. Candidates suggested by stockholders will be evaluated by the same criteria and process as candidates from other sources.

Risk Management Committee

The Risk Management Committee reviews and discusses with management the development and performance of the Company’s enterprise risk management program, investment guidelines for the Company’s investment portfolios, the Company’s insurance and risk management programs, and technology risks facing the Company, including information security and cyber defense mechanisms. The Risk Management Committee held four meetings in 2023. Its current members are Ms. Moradi (chair), Mr. Carley, and Mr. Clabby. The Risk Management Committee is governed by a written charter, which is available on the Company's website at www.BBSI.com in the "Investors" section under "Governance."

- 9 -

DIRECTOR COMPENSATION FOR 2023

The following table summarizes compensation paid to the Company’s outside directors for services during 2023. No outside director received perquisites or other personal benefits with a total value exceeding $10,000 during 2023.

Name |

|

Fees Earned |

|

|

Stock |

|

|

Total |

|

|||

Thomas J. Carley |

|

$ |

80,000 |

|

|

$ |

99,931 |

|

|

$ |

179,931 |

|

Joseph S. Clabby |

|

$ |

77,500 |

|

|

$ |

99,931 |

|

|

$ |

177,431 |

|

Thomas B. Cusick |

|

$ |

85,000 |

|

|

$ |

99,931 |

|

|

$ |

184,931 |

|

Jon L. Justesen(4) |

|

$ |

37,500 |

|

|

$ |

— |

|

|

$ |

37,500 |

|

Anthony Meeker |

|

$ |

146,069 |

|

|

$ |

99,931 |

|

|

$ |

246,000 |

|

Carla Moradi |

|

$ |

82,500 |

|

|

$ |

99,931 |

|

|

$ |

182,431 |

|

Alexandra Morehouse, NACD.DC |

|

$ |

77,500 |

|

|

$ |

99,931 |

|

|

$ |

177,431 |

|

Vincent Price |

|

$ |

80,000 |

|

|

$ |

99,931 |

|

|

$ |

179,931 |

|

(1) Directors (other than directors who are full-time employees of the Company, who do not receive directors’ fees) are entitled to receive an annual retainer payable monthly in cash. For 2023, the annual retainer was $65,000 for each outside director other than the Chairman of the Board, whose annual retainer was $135,000. Also throughout 2023, committee chairs and committee members received annual retainers as follows: Audit Committee, $15,000 and $7,500; Compensation Committee, $10,000 and $5,000; Risk Management Committee, $10,000 and $5,000; and Nominating Committee, $10,000 and $5,000.

(2) Reflects the grant date fair value of 1,146 RSUs based on the closing share price of the Common Stock as of the grant date, July 1, 2023, of $87.20 per share. All the RSUs vest on July 1, 2024, and will be settled by delivery of unrestricted shares of Common Stock on the vesting date. Each RSU represents a contingent right to receive one share of Common Stock.

(3) At December 31, 2023, each of the Company’s outside directors held 1,146 RSUs. The Company’s outside directors held stock options as follows: Mr. Carley, 6,250 shares.

(4) Mr. Justesen's service as a director concluded at the annual meeting held in June 2023.

CODE OF ETHICS

The Company has adopted a Code of Ethics for Senior Financial Officers ("Code of Ethics"), which is applicable to the Company's principal executive officer, principal financial officer, principal accounting officer, and controller. The Code of Ethics focuses on honest and ethical conduct, the adequacy of disclosure in financial reports of the Company, and compliance with applicable laws and regulations. The Code of Ethics is included as part of the Company's Code of Business Conduct, which is generally applicable to all of the Company's directors, officers, and employees. The Code of Business Conduct is available on the Company's website at www.BBSI.com in the "Investors" section under "Governance."

- 10 -

Background and Experience of Executive Officers

In addition to Mr. Kramer, whose background information is presented above under "Proposal 1- Election of Directors," Anthony J. Harris, Gerald R. Blotz and James R. Potts currently serve as executive officers of the Company.

Anthony J. Harris, age 40, joined BBSI in September 2016 as Controller. He was promoted to Executive Director of Accounting and Finance in March 2018. Then, in March 2020, he was promoted to Chief Financial Officer and Principal Accounting Officer. He became an Executive Vice President in May 2020. Prior to joining the Company, Mr. Harris served as Controller for Holland Partner Group from 2015 to 2016. Previously, Mr. Harris spent nine years with PricewaterhouseCoopers LLP in various roles in the United States and Australia, where he supported publicly traded and large privately held companies. Mr. Harris is a certified public accountant and received a BBA with a specialization in finance and accounting from Washington State University.

Gerald R. Blotz, age 54, joined the Company in May 2002 as Area Manager of the San Jose branch office. Mr. Blotz was promoted to Vice President, Chief Operating Officer-Field Operations in May 2014 and became an Executive Vice President in May 2020. Prior to joining the Company, Mr. Blotz was President and Chief Operating Officer of ProTrades Connection, where he was instrumental in building ProTrades to 44 offices in four states.

James R. Potts, age 56, joined the Company in September 2020, when he was appointed Executive Vice President, General Counsel and Secretary. Prior to joining the Company, Mr. Potts was Shareholder and Chair of Insurance, Corporate and Regulatory Practice, at Cozen O’Connor, a full-service international law firm, for 12 years. Mr. Potts has a JD from Georgetown University Law Center and a Bachelor of Science in Business Administration from the University of Florida.

STOCK OWNERSHIP OF PRINCIPAL STOCKHOLDERS

AND MANAGEMENT

Beneficial Ownership Table

The following table sets forth information regarding the beneficial ownership of Common Stock as of April 8, 2024, by each director and director nominee, by each executive officer named in the Summary Compensation Table under the heading "Executive Compensation" below, and by all current directors and executive officers of the Company as a group. In addition, it provides information, including names and addresses, about each other person or group known to the Company to own beneficially more than 5 percent of the outstanding shares of Common Stock.

Unless otherwise indicated, all shares listed as beneficially owned are held with sole voting and dispositive power.

Five Percent Beneficial Owners |

|

Amount and Nature |

|

|

Percent |

|

||

BlackRock, Inc.(2) |

|

|

523,689 |

|

|

|

7.9 |

% |

The Vanguard Group(3) |

|

|

384,711 |

|

|

|

5.8 |

% |

Private Capital Management, LLC(4) |

|

|

346,448 |

|

|

|

5.3 |

% |

Directors and Named Executive Officers |

|

Amount and Nature |

|

|

|

Percent |

|

||

Gerald R. Blotz |

|

|

74,705 |

|

|

|

|

1.1 |

% |

Thomas J. Carley (5)(6) |

|

|

32,159 |

|

|

|

* |

|

|

Joseph S. Clabby |

|

|

1,277 |

|

|

|

* |

|

|

Thomas B. Cusick |

|

|

7,148 |

|

|

|

* |

|

|

Anthony J. Harris |

|

|

14,509 |

|

|

|

* |

|

|

Gary E. Kramer |

|

|

81,702 |

|

|

|

|

1.2 |

% |

Anthony Meeker (6) |

|

|

15,721 |

|

|

|

* |

|

|

Carla A. Moradi |

|

|

2,806 |

|

|

|

* |

|

|

Alexandra Morehouse |

|

|

1,359 |

|

|

|

* |

|

|

James R. Potts |

|

|

7,301 |

|

|

|

* |

|

|

Vincent P. Price |

|

|

8,456 |

|

|

|

* |

|

|

All current directors and executive officers as a group |

|

|

247,143 |

|

|

|

|

3.7 |

% |

* Less than 1% of the outstanding shares of Common Stock.

- 11 -

(1) Includes options to purchase Common Stock exercisable currently or within 60 days following April 8, 2024, as follows: Mr. Blotz, 30,000 shares; Mr. Kramer, 20,000 shares; Mr. Carley, 6,250 shares; and all current directors and executive officers as a group, 56,250 shares.

(2) Based on information contained in the Schedule 13G amendment filed on January 26, 2024, by BlackRock, Inc., 55 East 52nd Street, New York, New York 10055, reporting sole voting power as to 514,271 shares and sole dispositive power as to 523,689 shares.

(3) Based on information contained in the Schedule 13G filed on February 13, 2024, by The Vanguard Group, 100 Vanguard Boulevard, Malvern, Pennsylvania 19355, reporting sole voting power as to 0 shares, shared voting power as to 11,607 shares, sole dispositive power as to 367,253 shares, and shared dispositive power as to 17,458 shares.

(4) Based on information contained in the Schedule 13G filed on February 5, 2024, by Private Capital Management, LLC, 8889 Pelican Bay Boulevard, Ste 500, Naples, Florida 34108, reporting sole voting power as to 140,405 shares, shared voting power as to 206,043 shares, sole dispositive power as to 140,405 shares, and shared dispositive power as to 206,043 shares.

(5) Includes 3,002 shares owned by Mr. Carley's spouse.

(6) Includes shares pledged as collateral for margin accounts with brokerage firms as follows: Mr. Carley, 18,907 shares; and Mr. Meeker, 400 shares.

Anti-Hedging Policy

The Company has adopted an Anti-Hedging Policy, which is applicable to the Company’s directors and executive officers, and prohibits them from directly or indirectly engaging in hedging against future declines in the market value of any Company securities through the purchase of financial instruments designed to offset such risk. Executive officers and directors who fail to comply with the policy are subject to Company-imposed sanctions, which may include a demotion in position, reduced compensation, restrictions on future participation in cash or stock incentive plans, or termination of employment. The Company’s Anti-Hedging Policy is available on the Company’s website at www.BBSI.com in the "Investors" section under "Governance."

Stock Ownership Guidelines for Non-Employee Directors and Executive Officers

The Board has adopted stock ownership guidelines such that each non-employee director is expected to own shares of Common Stock with a value equal to at least three times the regular annual cash retainer ($65,000 effective January 1, 2023), within three years of first being elected. The value of shares owned is calculated quarterly based on the higher of current market price or the average daily closing price for the preceding 12 months. Any shortfall resulting from an increase in the annual cash retainer or a decrease in the stock trading price (or both) is expected to be cured within two years following the end of the quarter in which the resulting required increase in share ownership first occurred.

The Board also adopted a policy on stock ownership for the Company's executive officers. Under the policy, executive officers will have five years from the later of July 1, 2016, and the date the executive officer is notified of his or her selection, to achieve and maintain ownership of shares of Common Stock with a value equal to at least three times the officer's annual base salary. Shares will be valued at the greater of the then current market price and the original purchase price. Until the minimum ownership level is reached, the officer is expected to retain at least 50% of the shares of Common Stock received upon exercise of an option or vesting of RSUs and performance shares, after payment of the exercise price and withholding and payroll taxes. Participants who are not in compliance will not be permitted to sell or dispose of shares, except as described in the preceding sentence, until they reach the required ownership level. The Nominating Committee may make an exception in its sole discretion in the case of financial hardship.

All non-employee directors and all executive officers have met the guidelines or are on track to meet the guidelines within the required timeframe.

PROPOSAL 2: AMENDMENT OF THE COMPANY’S CHARTER TO INCREASE THE AUTHORIZED SHARES OF COMMON STOCK

Overview of the Proposed Amendment

The Company’s Amended and Restated Charter (the "Charter") currently authorizes the issuance of 21,000,000 shares of capital stock, consisting of 20,500,000 shares of Common Stock, par value $0.01 per share, and 500,000 shares of preferred stock, par value $0.01 per share.

On April 8, 2024, the Board of Directors unanimously approved, subject to stockholder approval, a proposed amendment to the Charter (the "Proposed Amendment") to increase the number of authorized shares of Common Stock of the Company from 20,500,000

- 12 -

shares to 82,000,000 shares. The purpose of the Proposed Amendment is to facilitate a plan for a 4-for-1 split of the Company’s common stock, which was also approved by the Board on April 8, 2024, and would be effected through a stock dividend. The Board has determined the Proposed Amendment to be advisable and recommended that this proposal be presented to the Company’s stockholders for approval.

Purposes of the Proposed Amendment

As of the Record Date, we had a total of approximately 6,536,500 shares of Common Stock outstanding and a total of approximately 542,000 shares of Common Stock reserved for issuance pursuant to our 2020 Stock Plan and Employee Stock Purchase Plan, leaving approximately 13,421,500 shares of Common Stock available for future issuance, which is insufficient to implement the planned 4-for-1 stock split. If stockholders approve the Proposed Amendment, the number of shares of Common Stock which the Company is authorized to issue would increase from 20,500,000 shares to 82,000,000 shares, which is proportionate to the anticipated future increase in the total of outstanding plus reserved shares of Common Stock following the planned 4-for-1 stock split to approximately 28,314,000. The number of authorized shares of preferred stock available for issuance would remain at 500,000. The additional shares would have the same rights and privileges of the existing Common Stock presently issued and authorized. The Common Stock does not have preemptive rights or cumulative voting rights.

As noted above, the Board is recommending adoption of the Proposed Amendment to increase the number of authorized shares of Common Stock, to facilitate the plan for a 4-for-1 stock split, while maintaining the relative proportion of authorized and issued shares of Common Stock. The trading price of our Common Stock has risen significantly over the past several years, reflecting the strong performance of the Company. The Board believes that implementing a 4-for-1 stock split is likely to broaden the market for our Common Stock and facilitate trading by making the Common Stock more affordable to certain classes of investors, particularly individual retail investors. The additional shares of Common Stock issued in the form of a stock dividend to implement the stock split will be listed on Nasdaq, where our existing Common Stock is listed for trading.

Other than for shares reserved for issuance under existing equity compensation plans and shares that would be issued in executing the stock split, the Board has not approved any plans or proposals to issue any of the additional shares of our Common Stock that would become authorized. As with shares currently available for future issuance, any increase in the authorized shares of Common Stock not issued in connection with the stock split, would also be available for issuance from time to time in the discretion of the Board, without further stockholder action except as may be required for a particular transaction by law or the rules of a stock exchange on which the Common Stock is listed. Such shares of Common Stock could be used for any proper corporate purpose, including future acquisitions and capital-raising transactions. The Board believes that the Proposed Amendment will provide us with needed flexibility to issue shares in the future without the potential expense and delay associated with obtaining stockholder approval for a particular issuance.

If the stockholders approve the Proposed Amendment, it is presently the Board’s intent to cause the Proposed Amendment to be filed and become effective promptly after the Annual Meeting and to declare a stock dividend resulting in a 4-for-1 stock split of the Common Stock soon thereafter. If the circumstances that have motivated the Board to pursue a stock split were to change substantially, however, the Board may determine to postpone the filing of the Proposed Amendment or the declaration of the stock dividend, to change the amount of the stock split, or to abandon the filing of the Proposed Amendment or the stock split altogether. The Board’s decisions regarding declaration and payment of a stock dividend, including the number of shares to be issued, will depend on such factors as the Board deems relevant at the time, including the then-current trading price of the Common Stock, the financial condition of the Company, and general economic factors, among others. There is no assurance that the Board will ultimately decide to declare a stock dividend.

If the Proposed Amendment is approved, and in the event that the planned stock dividend is declared, we would make appropriate adjustments to all outstanding equity-based stock awards, including the numbers of shares covered and any exercise or base price. The number of shares of Common Stock issued and outstanding would increase and the number of shares available for future grants of awards under our 2020 Stock Plan would be adjusted proportionately. The Proposed Amendment will also remove language regarding the implementation of a stock split to facilitate the Company’s initial public offering in 1993, but will not affect the par value per share of our Common Stock.

Certain Risks Associated with the Proposed Amendment

The availability of additional shares of Common Stock for issuance could, under certain circumstances, discourage or make difficult any efforts to obtain control of the Company. We are not proposing an increase in the shares of Common Stock authorized for issuance for anti-takeover purposes, and we do not believe that increasing the availability of additional shares of Common Stock will discourage such attempts, if any, to take control of the Company. If a stock dividend is declared by the Board, the increase in the number of shares outstanding would result in a proportionate decrease in the Company’s earnings per share.

Effective Date of Proposed Amendment

The Proposed Amendment, if approved by the stockholders, will become effective on the date that the Proposed Amendment is filed as required by applicable Maryland law, which we presently expect to occur promptly after the Annual Meeting.

- 13 -

Required Vote

The affirmative vote of the holders of a majority of the outstanding shares of Common Stock entitled to vote will be required for approval of the Proposed Amendment. Abstentions (and broker non-votes, if any) will have the effect of a vote against the proposal.

The Board recommends that stockholders vote FOR the Proposed Amendment to the Charter to increase the authorized shares of Common Stock available for issuance.

PROPOSAL 3: ADVISORY VOTE TO APPROVE COMPENSATION OF OUR EXECUTIVE OFFICERS

Public companies are required to give their stockholders the opportunity, on an advisory basis, to approve or disapprove the compensation of their named executive officers and, at least every six years, to vote, on an advisory basis, on how frequently they would like the company to hold an advisory vote on the compensation of executive officers. At the 2023 annual meeting, the Company's stockholders approved the Board's recommendation that an advisory vote on executive compensation be conducted annually. Accordingly, we are conducting an advisory vote to approve the compensation of the Company's executive officers again this year. Unless the Board changes its policy, the next "say on pay" advisory vote will be held in 2025.

The Compensation Committee believes that executive compensation should align with the stockholders' interests, without encouraging excessive or unnecessary risk. This compensation philosophy and the program structure approved by the Compensation Committee are central to the Company's ability to attract, retain, and motivate individuals who can achieve our goals and provide stability in leadership. Our philosophies and goals with respect to compensation are explained in detail below under the subheading "Executive Compensation – Compensation Discussion and Analysis – Compensation Philosophy and Objectives." A detailed description of compensation earned or paid to our named executive officers in 2023 follows that discussion and analysis.

This advisory vote, which is not binding on the Company, the Compensation Committee, or the Board, is intended to address the overall compensation of our executive officers and the policies and practices described in this proxy statement. The Board and the Compensation Committee value the opinions of our stockholders and will take the outcome of the vote into account when considering future executive compensation arrangements.

The Board of Directors unanimously recommends that you vote, on an advisory basis, FOR the following resolution:

"RESOLVED, that the compensation paid to our named executive officers, as disclosed in this proxy statement pursuant to Item 402 of Regulation S-K adopted by the SEC, including the Compensation Discussion and Analysis, executive compensation tables and accompanying footnotes and narrative discussion, is hereby approved."

The above-referenced disclosures appear below under the heading "Executive Compensation" in this proxy statement.

The above resolution will be deemed to be approved if it receives the affirmative vote of a majority of the votes cast at the Annual Meeting. Abstentions and broker non-votes will have no effect on the outcome of the vote.

- 14 -

EXECUTIVE COMPENSATION

Compensation Discussion and Analysis

Compensation Philosophy and Objectives. The Compensation Committee (for purposes of this section, the "Committee") has responsibility for establishing, implementing, and continually monitoring adherence with the Company’s compensation philosophy. The goal of the Committee is to ensure that the total compensation paid to the Company’s executive officers is fair, reasonable, and competitive.

The Committee believes that the most effective executive compensation program is one that is designed to reward the achievement of specific annual and long-term strategic goals by the Company. The principles underlying our compensation policies are:

At the 2023 annual meeting of stockholders, more than 87% of the votes cast with respect to the advisory vote on executive compensation approved the compensation of the Company's named executive officers. The Committee took this information into consideration in reviewing the Company's executive compensation program. Our executive compensation program processes are consistent with those established by the Committee and are monitored by the Company’s finance functions.

Peer Group and Survey Data for Comparison Purposes. For several years, the Committee has retained Mercer, a nationally recognized compensation consultant, to provide advice to the Committee regarding the structure and implementation of the Company's executive compensation program. In the third quarter of 2021, the Committee asked Mercer to prepare an updated analysis of executive compensation data for all executive officer positions. In consultation with the Committee, Mercer developed an updated peer group for purposes of comparing the Company's executive compensation with similarly sized companies in the human resources and employment services and related industries. Mercer added three companies, Cross Country Healthcare, Inc., Insperity, Inc. and TrueBlue, Inc., and three companies were removed from the group.

An analysis by Mercer in 2021 of executive compensation paid by members of the revised peer group listed below was considered by the Committee in establishing executive compensation for 2023:

ASGN Incorporated |

|

James River Group Holding, Ltd. |

CBIZ, Inc. |

|

KForce Inc. |

|

Cross Country Healthcare, Inc. Heidrick & Struggles International, Inc. Huron Consulting Group Inc. ICF International, Inc. Insperity, Inc. |

|

Korn/Ferry International Mistras Group, Inc. Resources Connection, Inc. TrueBlue, Inc. United Fire Group, Inc. |

The peer group was developed in consultation with Mercer without consideration of individual company compensation practices, and no company was included or excluded from the peer group due to paying above-average or below-average compensation.

2023 Executive Compensation Components. For the fiscal year ended December 31, 2023, the principal components of compensation for executive officers were:

- 15 -

Base Salary

Salary levels of executive officers are reviewed periodically by the Committee and the CEO as part of the performance review process, as well as in connection with a promotion or other change in job responsibility. In determining base salaries for executives in 2023, the Committee primarily considered:

In February 2023, the Committee approved 2023 executive officer base salary levels, effective April 1, 2023, as follows: Mr. Kramer, $823,000, an increase of 4%; Mr. Harris, $450,000, an increase of 13%; Mr. Blotz, $535,000, an increase of 3%; and Mr. Potts, $355,000, an increase of 4%. The increases were based on the Committee’s evaluation of performance, as well as to peg salary levels for those positions closer to the median as compared to the Company’s peer group.

Annual Cash Incentive Compensation

The Company has an Annual Cash Incentive Award Plan (the "Annual Incentive Plan") that provides for annual awards of cash compensation to the Company’s executive officers based on the achievement of objective corporate performance goals selected by the Committee. In addition, the Committee typically awards discretionary bonuses based on each officer’s individual performance during the year. The total bonus opportunity for 2023 was divided such that 75% related to achievement of corporate performance goals and 25% to individual performance. Following year end, the Committee determined the extent to which the corporate and individual performance goals were achieved. An executive must remain employed by the Company through the date of the Committee's determination of performance to be eligible to receive annual cash incentive payouts.

In April 2023, the Committee set the target bonus amounts at 100% of base salary for Mr. Kramer and at 80% of base salary for Messrs. Harris, Blotz and Potts. The target amounts related to achievement of corporate performance goals were as follows: Mr. Kramer, $617,250; Mr. Harris, $270,000; Mr. Blotz, $321,000; and Mr. Potts, $213,000. The target bonus amounts tied to corporate financial metrics preliminarily approved by the Committee related to gross billings growth, net income, and gross margin as a percentage of gross billings, with each goal weighted equally. The cash payouts were subject to adjustment on a sliding scale based on the actual achievement of a given metric above or below the target level. Payouts for a given performance target would be 25% at the minimum achievement level and capped at 200% at the maximum achievement level. There would be no payout at an achievement level below the established minimum.

The following table shows the Committee's determination of the bonus payout percentages achieved for each respective metric under the Annual Incentive Plan.

Metric |

|

Target |

|

|

Actual |

|

|

Minimum Achievement Level |

|

|

Maximum Achievement Level |

|

|

Payout Percentages |

|

|||||

Gross billings growth |

|

|

7.40 |

% |

|

|

4.36 |

% |

|

|

5.18 |

% |

|

|

10.36 |

% |

|

|

0 |

% |

Net income |

|

$ |

43,081,575 |

|

|

$ |

50,612,451 |

|

|

$ |

36,619,339 |

|

|

$ |

51,697,890 |

|

|

|

187 |

% |

Gross margin as a percentage of gross billings |

|

|

3.00 |

% |

|

|

3.14 |

% |

|

|

2.85 |

% |

|

|

3.20 |

% |

|

|

170 |

% |

The actual payout amounts are shown in the Non-Equity Incentive Compensation Plan column of the Summary Compensation Table below.

The target bonus amounts for individual performance approved by the Committee in April 2023 were as follows: Mr. Kramer, $205,750; Mr. Harris, $90,000; Mr. Blotz, $107,000; and Mr. Potts, $71,000. The Committee received recommendations by the CEO with regard to the three executive officers other than himself. Goals for the executive team related to the 2023 rollout of the Company’s fully insured medical benefits program, including sales training and talent development, implementation of additional internal controls, and legal compliance, including data privacy. Additional individual goals focused on building an effective management team, implementation of a data driven revenue strategy, and improved management of vendor and procurement relationships and unemployment claims. In February 2024, consistent with the CEO’s recommendations, the Committee approved full payouts of the target discretionary bonus amount for each executive officer.

- 16 -

Long-Term Equity Incentive Compensation

In 2023, the Committee continued its practice of making annual grants of RSUs to the Company's executive officers under the Company’s 2020 Stock Plan. The Committee believes that RSUs provide a near-term opportunity to receive an ownership stake in the Company, thus serving as a significant incentive aligning the long-term interests of the executive team with the interests of the Company's stockholders. Each RSU represents a contingent right to receive one share of Common Stock. The RSUs granted to executive officers typically vest in four equal annual installments. The Committee fixed the dollar value of the annual RSU awards to executive officers granted on July 1, 2023, based on the closing sale price of the Common Stock on the date of grant, rounded down to the nearest whole share, as follows: Mr. Kramer, $1,234,500; Mr. Harris, $360,000; Mr. Blotz, $454,750; and Mr. Potts, $284,000. The awards are shown in the "All Other Stock Awards" column of the Grants of Plan-Based Awards table below.

The vesting of performance share awards granted in 2023 is conditioned on attaining specified target cumulative amounts of gross billings and net income before taxes for the three-year period ending December 31, 2025. The target dollar values of performance shares granted on February 28, 2023, were: Mr. Kramer, $1,234,500; Mr. Harris, $270,000; Mr. Blotz, $321,000; and Mr. Potts, $142,000, with 50% of the performance shares tied to achievement of each financial metric. Target award amounts are subject to upward or downward adjustment by 2.5% for each one percent by which the actual achievement of a given financial metric is above or below the target level, but not less than 80% of the target level or more than 140% of the target level. If achievement is below the 80% level, no part of the target award tied to that financial metric would be paid. At the 80% level, 50% of the target award for the related financial metric would be paid. The maximum payout is 200% of a target award. The awards in terms of numbers of shares are shown in the "Estimated future payouts under equity incentive plan awards" column of the Grants of Plan-Based Awards table below.